The Difference Between Bookkeeping and Accounting Bench Accounting

Bookkeepers don’t need a special certification, but a good bookkeeper is important for an accountant to have accurate financial records. When most people think about the difference between bookkeeping and accounting, they are hard-pressed to nail the distinction between each process. While bookkeepers subject to the and accountants share common goals, they support your business in different stages of the financial cycle. The bookkeeping and accounting field constantly evolves with new regulations, technologies, and industry practices. Successful bookkeepers and accountants embrace continuous learning and professional development to stay updated with changes in the industry. Pursuing certifications, attending seminars, and participating in relevant training programs demonstrate their commitment to professional growth and staying current in their field.

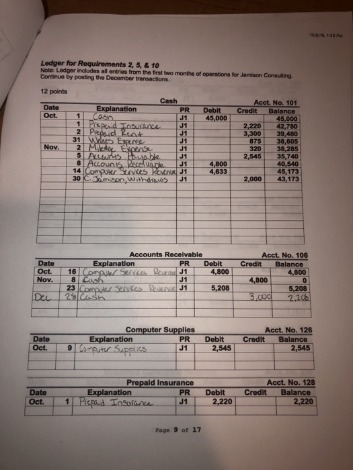

An Enrolled Agent (EA) is a specialized type of accountant that can advocate on behalf of your business when you have issues with the IRS. For example, if a bookkeeper does not pay invoices correctly, handle payroll accurately, or verify expenses, then all other accounting tasks may be harder to execute. If you’re searching for accounting software that’s user-friendly, full of smart features, and scales with your business, Quickbooks is a great option. The complexity of a bookkeeping system often depends on the size of the business and the number of transactions completed daily, weekly, and monthly. All sales and purchases made by your business need to be recorded in the ledger, and certain items need supporting documents. The IRS lays out which business transactions require supporting documents on their website.

Entrepreneurs and business owners often have multiple responsibilities and limited time. Hiring a bookkeeper allows them to delegate the time-consuming task of managing financial records. This enables the business owner to focus on core activities such as business development, strategy, and customer relationships. Accountants stay updated on tax laws and regulations to provide tax planning advice and ensure compliance. They prepare and file tax returns, maximize tax deductions, and liaise with tax authorities on behalf of the company. Bookkeeping is the foundation of any healthy financial system, whether for a small business or a large corporation.

- Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax.

- Accountants utilize financial data to develop forecasts and models that help businesses make informed decisions.

- This can lead to inaccurate financial information, missed payments, and an inability to make timely business decisions based on economic data.

- For example, some business owners only hire accountants to file their tax returns.

Time Management and Organization

They perform financial analysis and scenario planning to assess the potential outcomes of various business strategies. Accountants design and implement internal controls to safeguard assets, prevent fraud, and ensure compliance with financial regulations. They assess and manage financial risks, recommend mitigation strategies, and monitor internal control effectiveness.

Bookkeepers and accountants encounter complex financial challenges that require problem-solving and critical-thinking skills. They must be able to analyze financial issues, identify root causes, and propose practical solutions. Strong problem-solving and necessary thinking abilities enable them to troubleshoot discrepancies, resolve financial problems, and contribute to sound decision-making. Technology has introduced robust security measures to safeguard financial investors use leverage ratios to gauge financial health data. Cloud-based accounting platforms often employ advanced encryption, multi-factor authentication, and regular backups to ensure data security and protection.

Supporting Financial Analysis and Decision-Making

Hiring an accountant ensures compliance with tax laws, financial regulations, and accounting for gift cards industry-specific requirements. Accountants stay updated on changing rules and help businesses avoid penalties and legal issues. Bookkeeping focuses on the day-to-day financial activities and transactions of a business. Some of the key tasks for accountants include tax return preparation, conducting routine reviews of various financial statements, and performing account analysis. Another key responsibility for accountants includes conducting routine audits to ensure that statements and books are following ethical and industry standards.

Business Acumen

They explore and implement accounting software and tools that enhance efficiency, accuracy, and data management. Bookkeepers are responsible for recording and organizing financial transactions on a day-to-day basis. Hiring an accountant becomes crucial if the business undergoes audits or due diligence processes. Accountants ensure that financial records are in order, conduct internal audits, and prepare the necessary documentation. They help navigate the audit process smoothly and address any issues that may arise. As the business grows, the complexity of financial transactions tends to increase.

The following analysis compares the education requirements, skills required, typical salaries, and job outlooks for accounting and bookkeepers. Even though it will cost you to hire someone else to manage your books or file your taxes, you may also discover more savings by using a professional. A trained accountant can help you take advantage of deductions you didn’t know about.

Business acumen helps bookkeepers and accountants identify growth opportunities, assess financial risks, and contribute to the organization’s financial health. Cloud-based accounting software and platforms provide instant access to up-to-date financial information, allowing businesses to make informed decisions promptly. This can lead to difficulties in preparing tax returns, inaccurate financial reporting, and potential non-compliance with legal and regulatory requirements.